5 Simple Techniques For Amur Capital Management Corporation

Wiki Article

Facts About Amur Capital Management Corporation Revealed

Table of ContentsThe Facts About Amur Capital Management Corporation RevealedAmur Capital Management Corporation Things To Know Before You Get ThisThe Single Strategy To Use For Amur Capital Management CorporationAmur Capital Management Corporation for DummiesFacts About Amur Capital Management Corporation UncoveredSome Ideas on Amur Capital Management Corporation You Need To KnowThe Main Principles Of Amur Capital Management Corporation

A reduced P/E ratio may suggest that a firm is underestimated, or that capitalists expect the company to deal with harder times ahead. What is the optimal P/E proportion? There's no excellent number. Financiers can utilize the typical P/E ratio of various other companies in the same market to develop a standard - mortgage investment corporation.

Examine This Report on Amur Capital Management Corporation

The standard in the automobile and vehicle industry is just 15. A stock's P/E ratio is simple to find on the majority of economic reporting internet sites. This number suggests the volatility of a stock in contrast to the marketplace overall. A security with a beta of 1 will certainly show volatility that's the same to that of the marketplace.A supply with a beta of over 1 is in theory extra volatile than the market. A security with a beta of 1.3 is 30% more volatile than the market. If the S&P 500 rises 5%, a stock with a beta of 1. https://www.indiegogo.com/individuals/37861930.3 can be expected to rise by 8%

Rumored Buzz on Amur Capital Management Corporation

EPS is a buck figure representing the part of a firm's profits, after taxes and participating preferred stock rewards, that is assigned per share of typical stock. Financiers can utilize this number to gauge just how well a business can supply value to investors. A greater EPS begets greater share prices.If a company routinely falls short to deliver on revenues forecasts, a capitalist might wish to reassess purchasing the stock - accredited investor. The calculation is basic. If a business has a take-home pay of $40 million and pays $4 million in dividends, after that the staying sum of $36 million is split by the number of shares superior

The Amur Capital Management Corporation Diaries

Investors usually obtain interested in a stock after reviewing headings regarding its sensational efficiency. Simply keep in mind, that's the other day's information. Or, as the spending pamphlets constantly expression it, "Previous efficiency is not a predictor of future returns." Sound investing choices must consider context. A take a look at the fad in rates over the previous 52 weeks at the least is necessary to get a feeling of where a supply's cost may go next.Let's take a look at what these terms mean, just how they differ and which one is finest for the average financier. Technical experts comb via massive quantities of data in an initiative to forecast the direction of stock costs. The data is composed mostly of past rates info and trading volume. Essential analysis fits the requirements of many financiers and has the advantage of making navigate here great sense in the real life.

They believe costs follow a pattern, and if they can figure out the pattern they can utilize on it with well-timed trades. In recent years, innovation has actually allowed more capitalists to practice this style of spending because the devices and the information are extra available than ever before. Fundamental analysts take into consideration the inherent value of a stock.

The 7-Second Trick For Amur Capital Management Corporation

A lot of the principles talked about throughout this piece are common in the fundamental analyst's world. Technical analysis is best matched to somebody that has the moment and comfort level with information to place limitless numbers to use. Otherwise, essential analysis will fit the needs of many capitalists, and it has the advantage of making great feeling in the real life.Brokerage fees and mutual fund expenditure proportions draw cash from your portfolio. Those expenditures cost you today and in the future. For instance, over a period of two decades, annual charges of 0.50% on a $100,000 investment will minimize the profile's value by $10,000. Over the very same period, a 1% fee will minimize the exact same portfolio by $30,000.

The pattern is with you. Lots of shared fund companies and online brokers are lowering their charges in order to complete for customers. Capitalize on the fad and look around for the most affordable expense.

The 6-Second Trick For Amur Capital Management Corporation

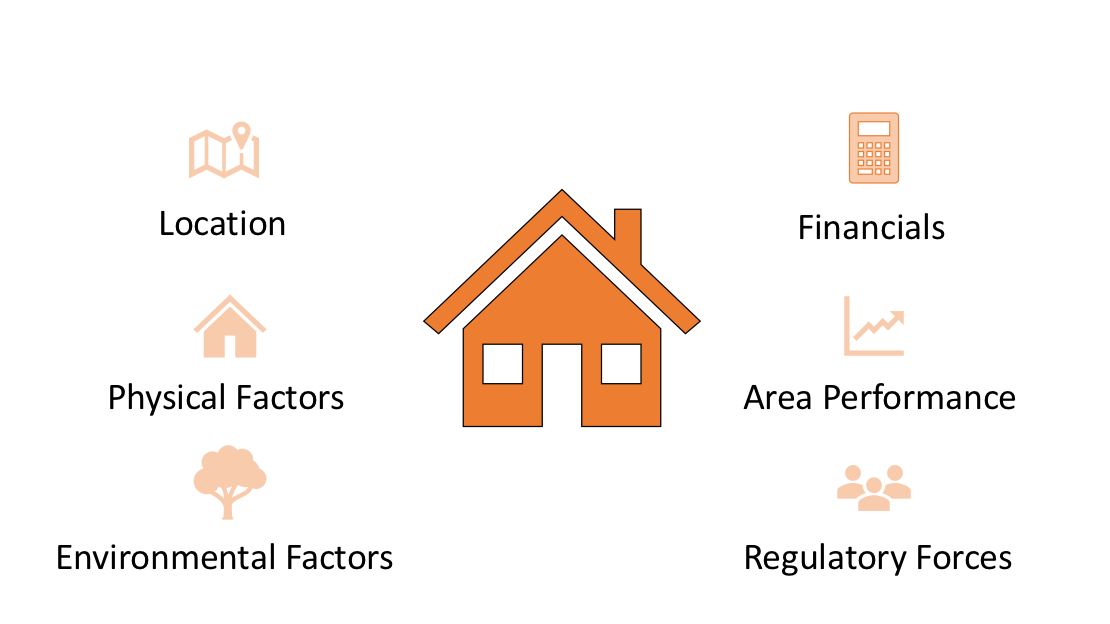

Closeness to features, environment-friendly space, picturesque sights, and the area's condition aspect prominently into home appraisals. Closeness to markets, storage facilities, transport hubs, highways, and tax-exempt locations play a crucial function in industrial property evaluations. A vital when taking into consideration home location is the mid-to-long-term view pertaining to how the area is expected to evolve over the financial investment period.

An Unbiased View of Amur Capital Management Corporation

Completely examine the ownership and desired use of the immediate areas where you prepare to spend. One way to gather information concerning the leads of the location of the residential property you are considering is to contact the city center or other public agencies in fee of zoning and metropolitan preparation.

Property assessment is necessary for funding throughout the purchase, sticker price, financial investment evaluation, insurance coverage, and taxationthey all depend on actual estate appraisal. Frequently made use of realty assessment methods consist of: Sales contrast approach: recent equivalent sales of buildings with comparable characteristicsmost common and ideal for both new and old buildings Cost technique: the price of the land and construction, minus depreciation appropriate for brand-new building and construction Earnings technique: based on expected cash inflowssuitable for rentals Offered the reduced liquidity and high-value investment in property, a lack of clarity on purpose might cause unexpected outcomes, including monetary distressespecially if the financial investment is mortgaged. This supplies regular revenue and long-lasting worth gratitude. This is usually for quick, little to tool profitthe common property is under building and construction and offered at a revenue on conclusion.

Report this wiki page